Contents - F.A.S.T. Graphs - Advisor Perspectives

Contents - F.A.S.T. Graphs - Advisor Perspectives

VF Stock Drops After Earnings. Margins Fell and Inventory Piled Up

Footwear Plus March 2023 by Wainscot Media - Issuu

Inline XBRL Viewer

Dow closes nearly 200 points higher, stocks snap two-day losing

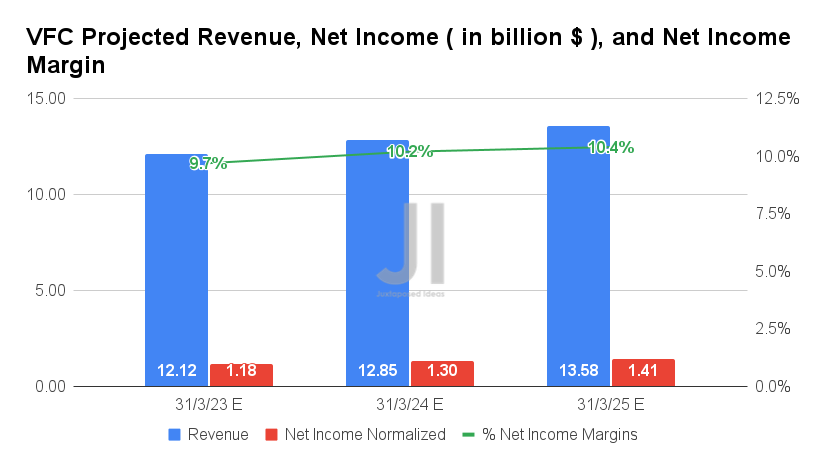

V.F. Corp: 6.12% Yield Is Here, Possibly 8.64% By FY2027 (NYSE:VFC

Footwear Brands & Retailers: Earnings & Sales Reports – Footwear News

Earnings Results :: VF Corporation (VFC)

Here's Why V.F. Corp (VFC) is Unlikely to Beat Earnings in Q3

6 Footwear Stocks to Buy in 2021, According to Wall Street

Blog Articles – Page 2 – FASH455 Global Apparel & Textile Trade