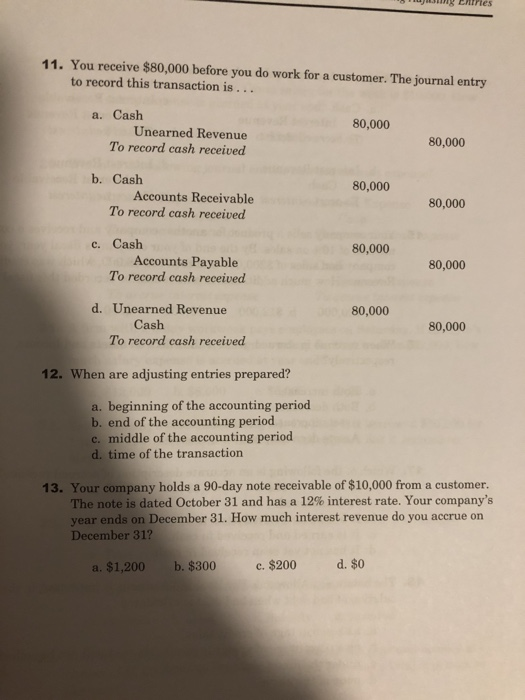

Solved TJ Enries 11. You receive $80,000 before you do work

Structuring Cash Transactions Under $10,000 is Criminal!

Money Laundering - Threat Assessment Guide by Tri State

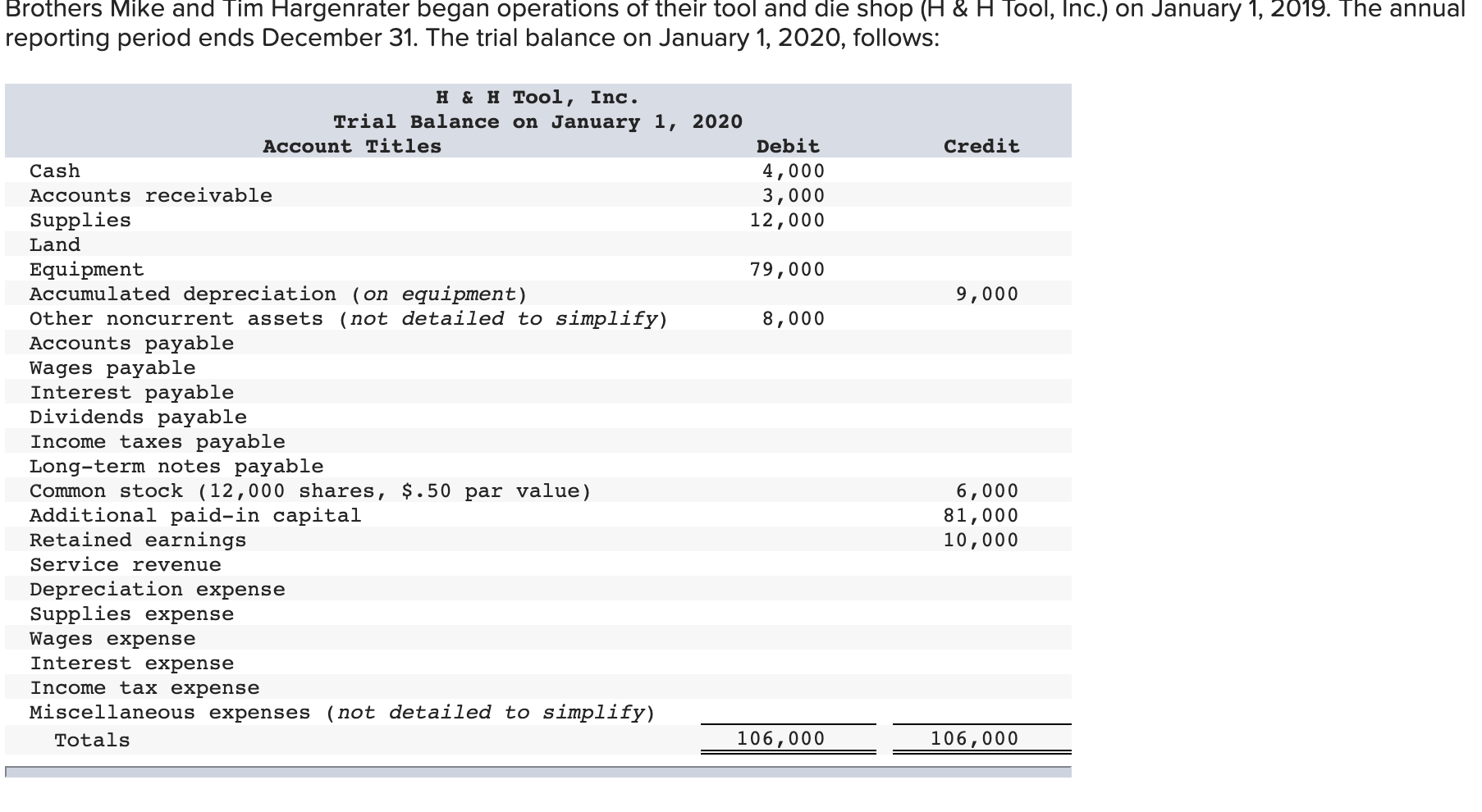

Solved Transactions during 2020 follow: a. Borrowed $20,000

Elements Financial CU: 4.25% APY Savings Until 10/31, 5.00% APY

2015 Annual Report by Roger Bacon - Issuu

IRS Tax Pros on X: In 2024, businesses that receive $10,000+ in

If You Deposit a Lot of Cash, Does Your Bank Report It to the

What You Need to Know About Buying a House With Cold, Hard Cash

If You Deposit a Lot of Cash, Does Your Bank Report It to the